The Boston Red Sox are continuing the process of Fenway Park development, with 2.1 million square feet of new space proposed by the team and its development partners.

We knew the Red Sox and partners D’Angelo Family, and WS Development were eying development on four parcels surrounding Fenway Park along Jersey, Lansdowne and Van Ness streets, and Brookline Avenue. And now we have some specifics, courtesy of filings by the team and its partners with the Boston Planning & Development Agency.

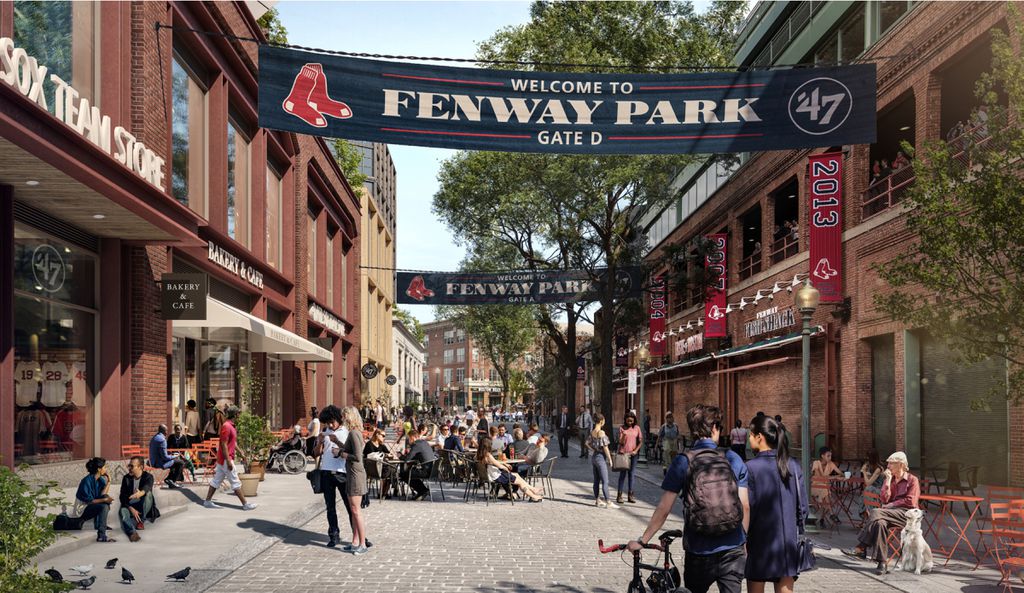

All in all, the proposal calls for 2.1 million square feet of retail, residential and office space facing Jersey and Landsdowne streets, with Jersey Street–now closed down on game days–permanently closed down. From the Boston Globe:

Specifics — such as building heights and the precise mix of uses — will be fleshed out as the project moves closer to BPDA review. Yanni Tsipis, who is leading the project for WS, said the developers hope to work closely with neighborhood groups to shape a project that makes sense for everyone.

“This is the first small step on a journey to transform the public experience around the ballpark,” Tsipis said. “We look forward to working with our Fenway neighbors to create something beautiful that embraces its historic context and is welcoming to all.”…

The project also calls for buildings on a large surface parking lot across Brookline Avenue from Fenway Park, and on the site of a squat garage along Landsdowne Street behind the Green Monster. Longer term, the group is considering building a so-called “air rights” development over the Turnpike behind that garage — though those highly-complex projects typically take years of careful planning.

As of now it’s almost easier to note which MLB teams are not boosting real-estate efforts than those who are. We’ve seen real-estate efforts in the MLB for decades now, but the efforts have ramped up in recent years. The Atlanta Braves really boosted the movement with the opening of Truist Park and the associated Battery mixed-use real-estate development, but before that teams like the San Francisco Giants had already been working on developments next to their home ballparks. The Colorado Rockies have invested in real-estate development next to Coors Field, the St. Louis Cardinals developed Ballpark Village next to Busch Stadium, the Chicago Cubs invested heavily in the Wrigleyville redevelopment that incl uded changes both to Wrigley Field and the surrounding neighborhood, and the San Diego Padres–who helped launch the trend with the construction of Petco Park, transforming downtown San Diego–won city approval for redevelopment of a desirable parcel next to the ballpark. Most recently Los Angeles Angels owner Arte Moreno negotiated a deal to purchase the 153-acre Angel Stadium site and redevelop it into a mixed-use site. It would be amazing if new ballparks in Tampa or Oakland didn’t include some sort of real-estate development as well; similarly, many experts say the real estate surrounding Citi Field is ripe for development–something the Wilpons never could accomplish, but which seems a natural for Steve Cohen.

Why does real-estate development appeal to MLB teams? It’s a way to leverage ballpark improvements outside the realm of baseball economics. Revenues from real-estate development do not appear on team ledgers and thus aren’t subject to luxury taxes and the like, much to the chagrin of agents like Scott Boras.

Rendering courtesy WS Development

RELATED STORIES: Red Sox enter MLB real-estate spree; New for 2021: MGM Music Hall at Fenway